Statement of Corporate Intent

Our Purpose

TCV’s purpose is a better future for Victoria

TCV sources capital and manages risks across the full breadth of the Victorian public sector. Clients include all Government departments via the Department of Treasury and Finance (DTF), local councils and water corporations. TCV also supports enterprises in the housing, arts, sports, entertainment, transport, commercial and industrial real estate, infrastructure, technology and healthcare sectors.

TCV contributes funding and supports investment to build housing, schools and hospitals, to maintain and upgrade roads and public transport systems, and the State’s water infrastructure. TCV also provides financing and supports investment to achieve Victoria’s climate action, energy transition and sustainability goals.

In these and many other ways, TCV has the opportunity and responsibility to achieve a lasting positive impact for the community.

Our Mission

TCV’s mission is to provide financial services and manage risk to benefit the State and our clients

TCV adds value and supports the financial stability and resilience of the State and our clients by centrally managing funding, liquidity and interest rate risks for the Victorian public sector.

By consolidating the management of these risks, TCV is able to achieve economies of scale, establish and maintain a risk governance and management framework, employ a team of highly skilled specialists, and deliver outcomes more effectively and competitively than if these tasks were undertaken by the State or our clients directly.

In practice, this means TCV:

- Raises capital in the wholesale financial markets to provide funding to the State and our clients

- Acts as the face of the State to financial markets, showcasing Victoria to the domestic and international investor community

- Supports clients and helps them achieve their goals. TCV does this by understanding clients’ needs and providing expert advice on funding, liquidity management, financial risk management, business plan development, economics and financial market conditions

- Supports a liquid market in TCV securities through the flexible and proactive management of the funding program in collaboration with TCV’s dealer panel. This enables TCV to provide investors with efficient access to high quality liquid investments.

Our Values

TCV’s values define how we embrace our purpose and mission

TCV’s values shape our culture and establish the expectations that we have for each other, and that our clients, stakeholders, and suppliers should have for us.

We care because our purpose matters and our business is based on relationships.

We make a difference because, while financial performance is a critical prerequisite, our success is defined by the broader impact we have.

We deliver because our clients and stakeholders trust us to help them achieve their goals, and the risks we manage are significant for the State and our clients.

We achieve together because everything we accomplish is done with the collaboration and support of others.

TCV also upholds the Victorian Public Sector values of Responsiveness, Integrity, Impartiality, Accountability, Respect, Leadership and Human Rights.

People and Culture

Aligning our people and culture to our purpose is fundamental to our strategy. Our focus is to ensure we preserve and enhance our culture, ensure that our people are valued and respected, supported and challenged, that they enjoy a sense of belonging and have the opportunity to thrive. Key people initiatives are focused on culture and values, learning and development, diversity and equality, and workplace health and wellbeing.

Our employees are engaged, experienced and have deep expertise.

Overall employee engagement, as measured by our most recent survey, was 79% based on a 94% response rate. This result placed TCV in the top quartile compared to an Australian government and financial services benchmark. In the same survey, over 90% of employees feel respected and culturally safe at work, feel supported in working flexibly, believe TCV takes steps to eliminate bullying, harassment, and discrimination, are proud to work at TCV and would recommend TCV as a good place to work. By promoting an inclusive, supportive, and dynamic work environment, we continue to empower our people to achieve excellence and contribute to a better future for Victoria.

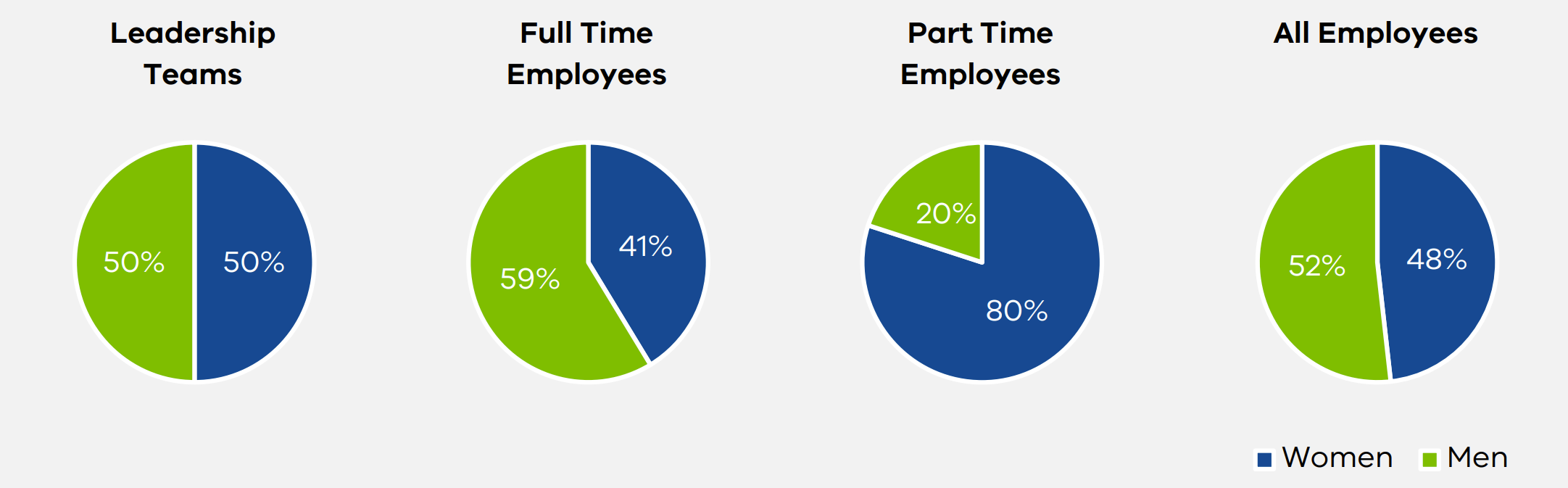

At 30 June 2024, TCV had 56 employees, comprised as follows:

Note: TCV does not have any employees who have identified as non-binary. Leadership teams comprise the Executive Leadership Team and the Senior Leadership Team.

More information on TCV’s Gender Equality Action Plan (GEAP) can be found here.

Relationship with the Treasurer of Victoria

The Treasurer of Victoria (Treasurer) is responsible for the administration of the Treasury Corporation of Victoria Act 1992 (the TCV Act).

In the exercise of its powers and performance of its functions under the TCV Act, TCV is subject to the general direction, control and specific approvals and determinations of the Treasurer.

The Treasurer’s interests are monitored by DTF, with prudential oversight provided by an independent Prudential Supervisor.

TCV’s payment obligations in relation to borrowings and derivative transactions are guaranteed by the State of Victoria (section 32 of the TCV Act). TCV’s loans are made directly to the State of Victoria or are guaranteed by the State of Victoria.

Our business

Client services

TCV provides treasury services to those state and public authorities that have been accepted as participating authorities by the Corporation under the TCV Act. We also provide these services to other Victorian entities at the request of the Treasurer.

We provide tailored loans to clients, which are available on demand and provided at wholesale rates. Client loan facilities can extend from short-term at call facilities to long-term commitments of 30 years or more.

We also provide cash and liquidity management services, interest rate, foreign exchange and commodity hedging, and advise clients in relation to financial risk management, debt portfolio management, financing strategy, treasury policies and related matters. TCV also provides specialist financial advice in relation to PPP procurement and financing, contract management, and renewable energy programs and projects.

Funding and markets

To finance our lending activity to the State and our clients, TCV maintains access to a broad range of borrowing programs that provide access to long and short-term funding in domestic and international debt capital markets and facilitate a diversified investor base.

TCV is an active issuer across its benchmark curve in response to investor appetite and to spread refinancing risks over time. We have a flexible approach to delivering the funding task, including issuing into existing and new benchmark bond lines, using a combination of bond tenders, syndication, and reverse enquiry and issuing under our Sustainability Bond Framework.

The combination of our funding programs and our proactive approach to issuance allows TCV to provide access to sources of liquidity and meet client funding requirements in volume and duration at a competitive price regardless of market conditions.

Operations

TCV’s Risk, Finance, Information Technology, People and Culture and Legal functions together provide the expertise, governance and organisational capacity that enables us to deliver for our clients and manage our business and operational risks effectively and efficiently.